It’s a known fact that Americans take on extra debt during the holiday season.

According to a 2022 survey from Lending Tree, the average additional debt taken on over the holidays exceeded $1,500 last year, a figure that was about $300 higher than the previous year. As a result, some consumers will choose to pay their rent with a credit card.

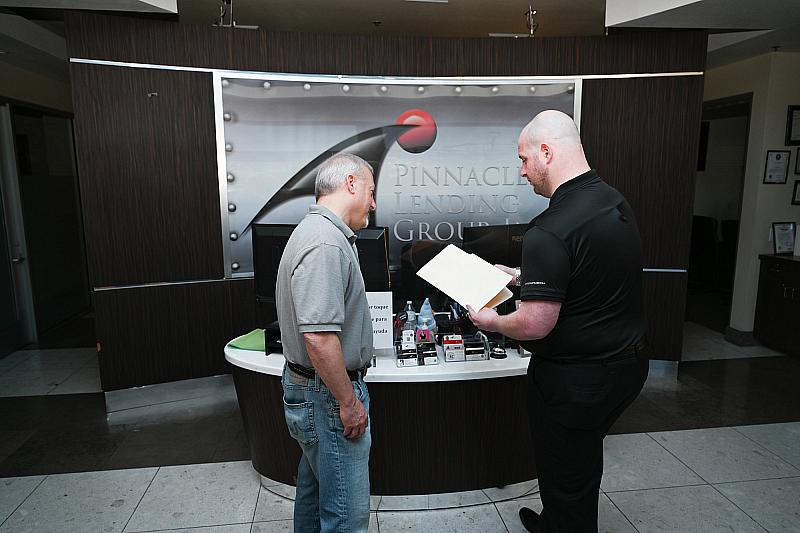

That’s something Andrew Leavitt discourages. Leavitt is affiliated with Pinnacle Lending Group (https://www.pinnacleloans.com/) and is a member of the State of Nevada Financial Literacy Advisory Council.

The expert says this move is a common decision for some consumers this time of year, but it only leads to bigger problems down the road.

“Relying on short-term borrowing to pay for regular expenses without a clear repayment plan can lead to a vicious debt cycle that may be difficult to overcome,” he explains. “This is precisely how credit card companies generate substantial revenues, as consumers end up paying for decades to come.”

Leavitt provides a wide range of tips to help those he works with avoid financial pitfalls this time of year (ie: applying for store credit cards, putting off debt repayment, etc.).

Consumers can also find plenty of free resources on his DocsOut.ai (https://docsout.ai/) website.

Source: ImageWords Communications